We believe that investment returns are determined principally by risk, and that a diversified portfolio's expected return is a result of its exposure to certain risk market-based factors. Since a portfolio's asset allocation determines its risk factor exposure, how to allocate one's assets into purpose based pools of money is one of the most important decisions an investor can make.

Our research has identified five risk factors that we believe determine the expected rates of return of a diversified portfolio. The first three are stock market risk factors and the last two are fixed income risk factors:

Market Risk

-

Stocks in general have higher expected returns than fixed income securities.

Size Risk

-

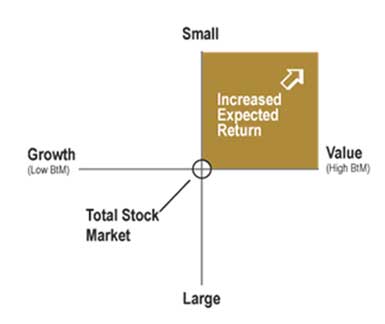

Small company stocks have higher expected returns than large company stocks.

Valuation Risk

-

Lower-priced "value" stocks have higher expected returns than higher-priced "growth" stocks.

Profitability Risk

- Securities with higher profitability have higher expected returns.

Maturity Risk

-

Longer-term instruments are riskier than shorter-term instruments and therefore have higher expected returns.

Default Risk

-

Instruments of lower credit quality are riskier than instruments of higher credit quality and therefore have higher expected returns.

Academic studies show that the degree to which a portfolio is exposed to these five risk factors determines nearly all of its risk and expected return. An advantage of purpose based investing is the ease in which one can manage risk by investing in precise asset classes.

You can visualize the equity risk components with the illustration below. The extent to which you "tilt" your portfolio toward small and value stocks can increase your risk and expected return.

Cross Section of Expected Stock Returns, Eugene F. Fama and Kenneth R. French, Journal of Finance 47 (1992)